If you are considering refinancing to help you a good 15-12 months mortgage, now is a great time and make their circulate. Even if prices are no lengthened at list lows we saw during the new pandemic; it will still be beneficial by historical requirements. There are an incredible number of property owners which you’ll make use of a re-finance.

Even though many men and women have a tendency to pick a new 30-year mortgage, certain will envision an excellent fifteen-12 months home loan. Shortening the loan identity is usually an educated financial choices your previously generate. However it is the incorrect decision for everyone, and you will finish overestimating your ability to settle the fresh financing.

Consumers must always take care to weighing the solutions before examining good fifteen-year re-finance. Think about your current financial climate and you will if it is sensible to boost their homeloan payment. Following do not forget to account fully for your upcoming requirements and exactly how increased household percentage will keep you from achieving them.

On this page, we take a closer look during the particulars of refinancing so you’re able to an effective fifteen-seasons mortgage. Understanding the pros and cons for the program will allow you to take advantage of informed decision and place on your own upwards having monetary success.

How much does they mean so you’re able to refinance so you’re able to fifteen-12 months financial?

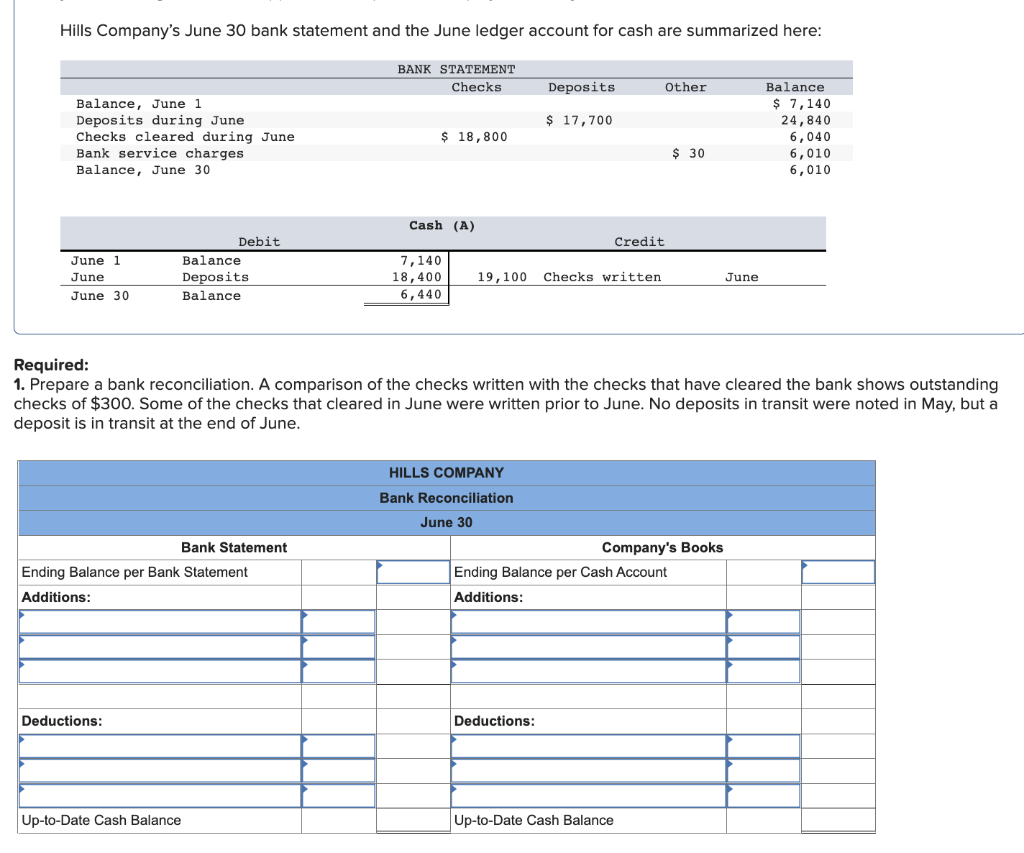

Let us explore what this strategy requires to start with. State you took away a 30-year mortgage that have an amount borrowed off $three hundred,000 and you will good 4% interest rate in 2019. During the time, perchance you chose the name with the most affordable payment and you may think little more than you to definitely.

Today, fast send many years so you’re able to 2022. Have you ever increased-expenses occupations and you will less debt obligations. The blend out of more cash and additional area on the funds means you can realistically manage a high mortgage payment.

Thus, you begin the fresh new conversation that have a home loan representative. It manage the fresh amounts and find one refinancing to help you good fifteen-year home loan (when you’re getting the exact same cuatro% rate and you may $300,000 amount borrowed) carry out enhance your payment of the nearly $800. Yet not https://cashadvanceamerica.net/, you discover those people high money can save you $83,000 into the interest and permit you to pay off the loan several many years sooner.

Think of a good re-finance to an effective fifteen-seasons home loan since substitution your current mortgage with a brand new home loan with a special name. This particular loan kind of pris for the reason that a borrower pays a great deal more for a while having greater savings ultimately. You possess your house faster which have a good 15-12 months mortgage and can availableness their equity in the course of time also.

Benefits associated with good 15-year home loan

Can you imagine you will no longer need to agree to a 30-year mortgage. Yes, it might seem to pay even more on your prominent occasionally. not, the alternative was switching to a good fifteen-year name and you can enjoying the after the professionals.

High discounts

Most people cannot create extreme damage within financing to have ages. Only check your newest home loan report. Odds are, your primary money are going to attract, especially if you are in early many years of cost.

It is another type of facts when our company is talking about a 15-year mortgage. The new reduced label ensures that individuals are responsible for a minority of one’s attention. So you may be in range to save millions regarding dollars by refinancing to the a great 15-season financial.

A great deal more equity, less

Collateral is actually queen with regards to homeownership. Because the a great refresher, you might compute this shape by subtracting your loan amount owed regarding the property’s really worth. Instance, whether your house is valued in the $3 hundred,000 and you’ve got $250,000 leftover on your own mortgage, might enjoys $50,000 when you look at the security.

But how do guarantee progress vary ranging from a thirty-seasons and you can a beneficial 15-12 months home loan? Almost everything ties to the eye. Quicker you could potentially reduce the interest, the faster you processor chip away during the dominant – while the even more security your accrue.

“Ought i Refinance to help you a beneficial 15-Seasons Financial?” için 0 yanıt